What’s the Difference Between Student Loan Settlement and Student Loan Refinancing?

Taking out student loans is a necessity for most students who want to attend college. Once they separate from school, new grads may begin to feel stressed when they look at the total debt that they owe. There are options available to pay off student loan debt more efficiently and with less stress. Student loan settlement and student loan refinancing are popular choices, but which is the most beneficial option?

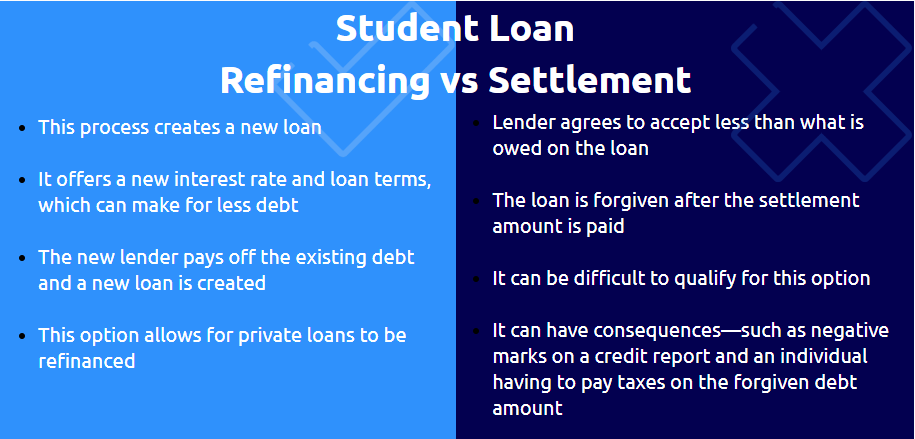

Today we’ll break down the differences between settlement and refinancing so that you can make a more informed choice and take charge of your finances:

What is Student Loan Settlement?

What is a student loan settlement? It’s an agreement your lender/collection agency can agree to accept less money than what is originally owed for the loan. In exchange for the agreed-upon payment, the principal loan is brought to a zero outstanding loan balance.

While this may seem attractive, it’s important to note that it can be tough to qualify for a settlement. Here’s why:

- Most lenders want to be paid the full amount due and don’t want to accept less money than what is owed

- If the loan is still being paid and is not in default, lenders can see that you’re capable of continuing to make payments, even if money is tight

- Many private lenders are less likely to offer a settlement on the outstanding balance

Student loan debt settlement also has negative consequences. This can impact you and your finances in many ways. Here are some of the implications of this choice:

- It can negatively impact your credit score, making it difficult to take advantage of future financial opportunities

- A 1099-C tax form is issued to individuals who accept a debt settlement over $600 in principal forgiveness, meaning that they’re still responsible for paying taxes on the forgiven debt (this can add up!)

- Many lenders won’t consider settlement until you’re in default, which means you’d have to stop paying your loans for a long time—which impacts your credit score

Before deciding to accept a student loan settlement, consider other options—like student loan refinancing. This can offer some great benefits with less financial consequences.

What is Student Loan Refinancing?

Student loan refinancing is another option to consider, and it can be a much better choice. With this option, individuals can refinance their existing loan(s) and take advantage of better terms. The new lender will pay off the existing debt and then issue a new loan with different terms.

Refinancing a student loan may offer the following:

- A better, lower fixed interest rate

- Smaller, more manageable monthly payments

- An opportunity to pay off student loan debt faster

A student loan refinance can also help you feel less stressed about your financial situation. If you’re struggling to pay your monthly student loan bills, it’s a smart idea to look into private student loan refinancing programs by Yrefy and others. It’s an especially great option for former college students who have private student loans with undesirable loan terms.

Who is a Good Candidate for Student Loan Refinancing?

Student loan refinancing is an excellent option for many people. Whether you just graduated or you’ve been working in your career field for a couple of years, it’s an option to consider. You may be the right candidate for this opportunity if any of the following apply:

- Your loan payments are too high due to variable and high-interest rates

- You have delinquent or defaulted student loans

- You’ve continued to pay your student loan bills, but you’re barely scraping by

- You have verifiable income that shows you can continue to pay your loans

- Your consolidating debt into a single monthly payment, more manageable

Lenders want to see that you have income coming in to show that you’re able to pay your new loan. Are you wondering if this is a possibility for you? The good news is you don’t have to have a high credit score to qualify for student loan refinancing.

Lenders like Yrefy work with individuals in a variety of situations to help them rework their private loans. They also work with individuals with low credit scores and poor credit history. On average, Yrefy’s refinance loan rates are 4.0%, and their rates aren’t dependent on credit score.

If you’re feeling overwhelmed about your student loans, be sure to get the help you deserve. You can pay off your private student loan debt in a responsible way. If you want to learn more about student loan refinancing, reach out to Yrefy to start the application process. Yrefy offers affordable, fixed student loan rates.