Student Loan Refinance or Consolidation with Low or Bad Credit: What You Need to Know

Table of Contents

Refinancing with Bad Credit

Bad credit can feel like a heavy financial burden to carry. Your credit impacts everything from obtaining a new private student loan to refinancing a current one, but it doesn’t have to prevent you from taking control of your financial future.

Here’s the good news: credit scores can improve, and there are many lenders who specialize in working with student loan borrowers who have low credit (including Yrefy).

If you have low credit and want to learn more about refinancing, rebuilding credit, or gaining clarity on the many terms and programs available, this guide is for you.

Challenges and Credit Impact

Refinancing a loan with bad credit isn’t easy, but understanding why is a key step in navigating the student loan refinance or consolidation process.

A credit score is like a financial report card, and it’s often one of the first parts of an application reviewed by a lender. They are an easy way for lenders to determine if a borrower can meet a payment obligation. Missed or late payments, defaults, collections, or high credit utilization can lower a credit score and indicate a higher risk level for a lender. With the appearance of higher risk can come less favorable loan terms for a borrower.

Less favorable terms can include higher interest rates, the need for a co-signer, or even outright denial.

Even the act of applying for a new loan or refinance can temporarily lower your credit score. When a borrower applies for a loan or refinance, the lender may conduct either a soft or hard credit inquiry.

A soft inquiry allows the lender to review basic credit information without typically affecting your score. A hard inquiry provides a full credit report and can cause a small, temporary drop in your score. Hard inquiries signal to lenders that you may be taking on new debt, which increases short-term risk and leads to the score drop.

This can feel incredibly frustrating, especially when it seems like everything depends on a single number. But there’s more nuance to the process, and there are options available for borrowers, even those with low credit.

Many lenders recognize that credit scores don’t tell the whole story of a borrower’s financial situation. Responsible financial behavior such as making consistent payments, reducing debt, and showing steady income can help offset a lower score over time.

Federal Loan Options

It’s important to know right off the bat that borrowers with federal loans cannot refinance their federal student loans through the U.S. Department of Education (ED). Why? The ED does not refinance its own loans, because the interest rates are set by Congress each year. The rates apply only to newly issued loans. However, federal loans can be refinanced through a private lender, but there are changes borrowers should understand before doing so.

If a federal loan is refinanced through a private lender, that loan becomes a private loan. This means a borrower may lose associated federal protections, repayment plans, deferment and forbearance options, and potential forgiveness programs. If a borrower wants to keep their loan with the ED, other options such as Direct Consolidation may be a better choice.

Direct Consolidation

The ED allows borrowers to combine multiple federal student loans into a single loan that has a new interest rate. The new interest rate will be the weighted average of all the loans’ interest rates, rounded to the nearest one-eighth. Loan consolidation is typically pursued to reduce multiple monthly payments into a single payment. In some cases, this may result in a lower monthly payment or an extended repayment term.

While loan consolidation can make tracking monthly payments easier, it’s not the same as refinancing. The total interest paid over the life of the loan may increase due to the extended repayment term, and the new interest rate may not necessarily be lower. Consolidating federal student loans is primarily used to simplify payments and maintain access to federal repayment plans such as Income-Driven Repayment (IDR) plans.

For more information and full eligibility requirements, view the Consolidating Student Loans page on the StudentAid.gov website.

Income-Driven Repayment Plans

Borrowers with federal student loans may be eligible to enroll in Income-Driven Repayment (IDR) plans, which base monthly payments on a borrower’s income and family size. These plans are unique, as they account for a borrower’s ability to make student loan payments while caring for the financial needs of themselves and their families.

There are multiple IDR plans, including:

- Income-Based Repayment (IBR) Plan: Payments are generally 10-15% of discretionary income and may offer forgiveness after 20-25 years of qualifying payments.

- Income-Contingent Repayment (ICR) Plan: Payments are based on income, family size, and loan amount, and may offer forgiveness after 25 years of qualifying payments.

- Pay As You Earn (PAYE) Repayment Plan: Payments are generally 10% of discretionary income and may offer forgiveness after 20 years of qualifying payments; not offered to new borrowers as of July 1, 2024.

- Saving on a Valuable Education (SAVE) Plan: The newest IDR plan, designed to lower payments by protecting a portion of income and reducing interest accumulation, and may offer forgiveness after 20–25 years of qualifying payments depending on the loan type.

- Repayment Assistance Plan (RAP): Forthcoming plan for eligible borrowers; details on payments and forgiveness to be determined.

IDR plans require a borrower to recertify their income and family size each year, which may result in yearly adjustments to payments. These plans also allow borrowers to request loan forgiveness after making 20 or 25 years of qualifying payments (depending on the plan and loan type).

For more information and for full eligibility requirements, view the Income-Driven Repayment Plans page on the StudentAid.gov website.

Private Loan Options

For borrowers with private loans, refinancing or consolidating is handled by private lenders like banks, credit unions, or refinance companies. Private student loans do not have the same available repayment plans that federal loans do. Each lender has its own terms, interest rates, repayment plans and relief policies. Unlike federal loans, private lenders consider a borrower’s financial profile when issuing a new loan, or when reviewing an application to refinance an existing loan. This review can include:

- Credit Score: Borrowers with higher credit scores may qualify for lower interest rates, though this varies by lender. A credit score of 670 – 739 is generally considered good.

- Income and Career Stability: A record of stable monthly income can help a borrower qualify, as it demonstrates the ability to consistently repay loans.

- Debt-to-Income Ratio (DTI): Lenders review how much of a borrower’s monthly income goes toward debt. A lower DTI indicates a stronger ability to meet repayment obligations.

If a borrower still needs additional support to qualify, some lenders may require a co-signer for the loan. A co-signer is typically a family member or close friend who agrees to share the legal obligation to pay the loan if the borrower fails to make payments. In many cases, a co-signer can be released from the loan after a series of successful payments, or if the borrower refinances with another lender.

It’s important to note that borrowers with low credit may still qualify for refinancing and/or consolidation, as private lenders often review multiple aspects of a borrower’s financial profile.

Many lenders, such as Yrefy, actually specialize in helping borrowers with low credit scores!

Strategies to Refinance or Consolidate with Bad Credit

Even with bad credit, there are strategies that can be utilized to refinance or consolidate a student loan. The key is to do your research.

Compare Lenders and Loan Types

There are many lenders who specialize in student loan refinancing and consolidation, and they offer different rates and programs.

To compare them, build a simple tracker and write down each lender’s basics such as company name, interest rate and type (fixed or variable rate), loan repayment terms, and other important information such as potential relief programs and eligibility requirements. During this process, highlight lenders who specialize in helping borrowers with defaulted or delinquent loans or low credit scores. This simple tracker will allow you to narrow your search to a few lenders who can be researched more thoroughly.

Example Comparison Tracker

| Lender Name | Interest Rate | Rate Type | Repayment Terms | Notes |

|---|---|---|---|---|

| ABC Lending | 5.25% | Fixed | 10 – 20 years | Low credit welcome |

| XYZ Bank | 4.75% | Variable | 5 – 15 years | Defaulted loans considered |

| 123 Finance | 6.00% | Fixed | 10 – 25 years | Requires a co-signer |

Weigh Refinancing vs. Consolidating

If you have federal loans, consolidating through the Department of Education may help simplify payments and will maintain your access to federal programs. However, if your primary goal is to secure a lower rate or fixed rate, or combine federal and private loans into a single payment, refinancing with a private lender might make more sense. Understanding your long-term goals will help determine which path is right for you.

Refinancing vs. Consolidation

| Consolidation (Federal) | Refinance (Private) | |

|---|---|---|

| Purpose | Combine multiple federal loans into one | Replace one or more existing loans with a new loan and a new interest rate |

| Eligible Loans | Federal student loans only | Private student loans, and in some cases, federal loans through a private lender |

| Interest Rate | Weighted average of existing federal loans | Set by lender, can be fixed or variable |

| Repayment Plans | Federal repayment plans | Determined by lender |

| Credit Check Required | No | Yes |

Strategically Apply

Before submitting a formal application, speak with multiple lenders and get a feel for their customer service and response times. Look at testimonials and reviews from other borrowers and look for common themes. If possible, write down the names of the loan officers you speak with, as you may work with them in the future. You can even put this information in the tracker, mentioned above!

Once a strong list has been built, explore prequalification checks with lenders using a soft credit check to confirm available rates and options.

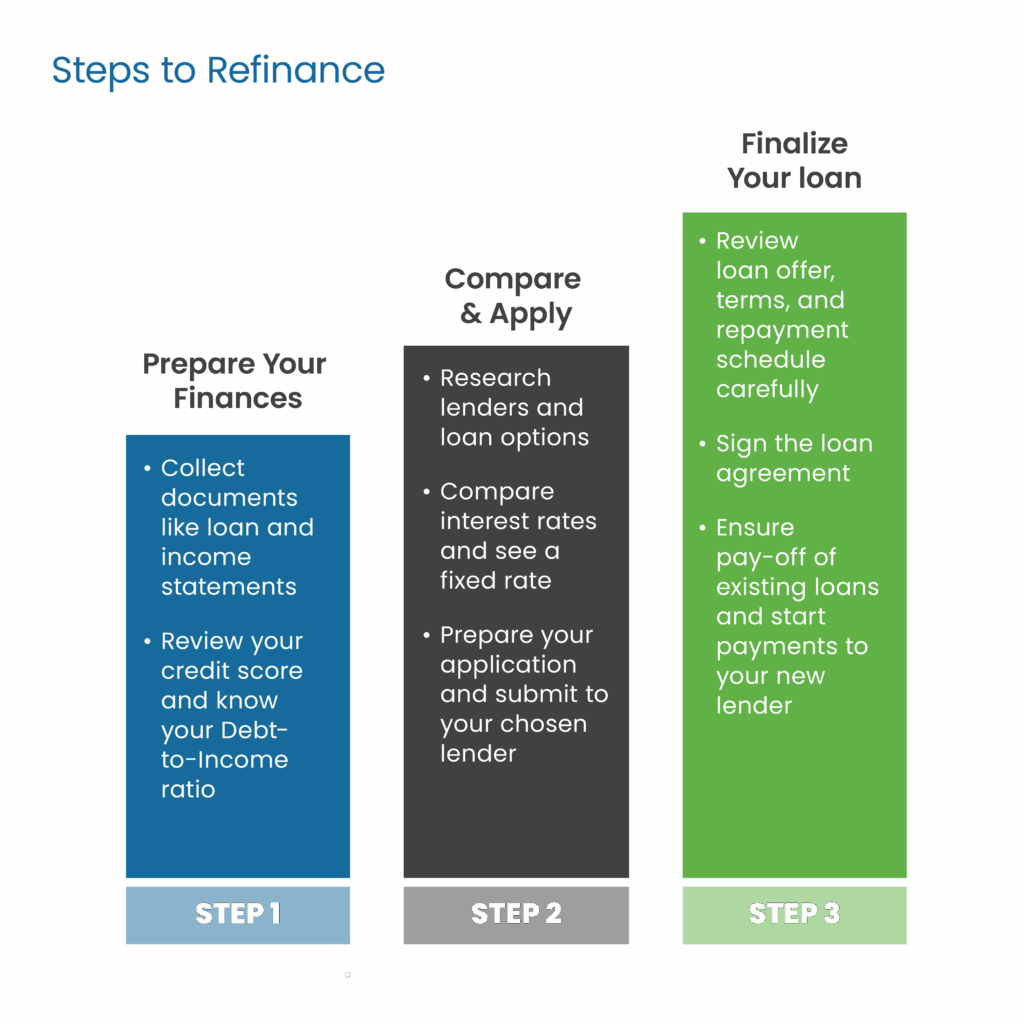

What to Do Before Refinancing

Even with low credit, there are still ways to improve your chances of qualifying for a loan refinance or consolidation. The key is to show lenders you are moving toward financial stability, even if your credit score isn’t there yet. You can do this by:

Reviewing Your Credit Report

Review your credit report and correct any potential errors and/or outdated information. Credit reports may have errors in them, and even a small correction or update could help raise your credit score.

Building Payment Consistency

Focus on making on-time (or even early) payments for all current bills, like utilities, car loans, rent or mortgage, and credit cards. Small improvements in your payment history demonstrate reliability.

Considering a Co-Signer

If qualifying for refinance or consolidation on your own is difficult, consider adding a co-signer with a stronger credit score to improve your chances of approval. Remember, a co-signer is equally responsible for repaying the loan. Clear communication of their role and obligations is critical before moving forward.

Winning Small Credit Victories

If possible, focus on reducing your overall debt, and consider targeting a smaller loan for complete repayment. Closing out a current loan on your credit report can have a strong impact. Reducing overall debt can lower your DTI ratio, which is calculated by dividing your total monthly debt payments by your monthly gross income. Knowing your DTI ratio can help you determine which debts to prioritize in order to bring the ratio down.

Special Cases: Bankruptcy and the 7-Year Rule

If you have undergone a bankruptcy proceeding, or are considering bankruptcy, there are some impacts to understand regarding how it may affect your student loans. While there are six types of bankruptcy, we will focus on Chapter 7 and Chapter 13.

Chapter 7 Bankruptcy

Chapter 7 allows an individual to discharge many types of unsecured debt such as credit card debt, medical bills and some personal loans. Under Chapter 7, federal and private student loans are not typically discharged, which means they remain an active obligation even after filing. While this type of bankruptcy can reduce overall debt, it can negatively impact future attempts to secure refinancing, consolidation, or new loans. Chapter 7 bankruptcy typically remains on a credit report for ten years from the filing date.

Chapter 13 Bankruptcy

Chapter 13 allows an individual to establish a court-approved, structured repayment plan that usually occurs over three to five years. Student loans can be included in this repayment plan. Having a history of Chapter 13 on your credit report may negatively affect your score; Chapter 13 bankruptcy typically remains on a credit report for seven years from the filing date. However, successful completion of payments via the structured repayment plan can have a positive impact over time.

The 7-Year Rule

Generally, negative records on a credit report (which impact a credit score) remain for up to seven years; this is known as the 7-year rule. However, the exact time period can depend on the type of negative record. Most follow the standard seven-year limit, but certain public records, like court judgments, may be removed sooner in some states. For example, in New York some judgments can drop off after five years. After this period, these negative impacts typically fall off, which can help improve your credit score and increase your chances of refinancing or consolidating student loans.

Navigating bankruptcy or recovering from negative credit events can be challenging, but it’s not a permanent barrier. Understanding how these special cases affect refinancing and consolidation can help you plan strategically and rebuild your credit over time.

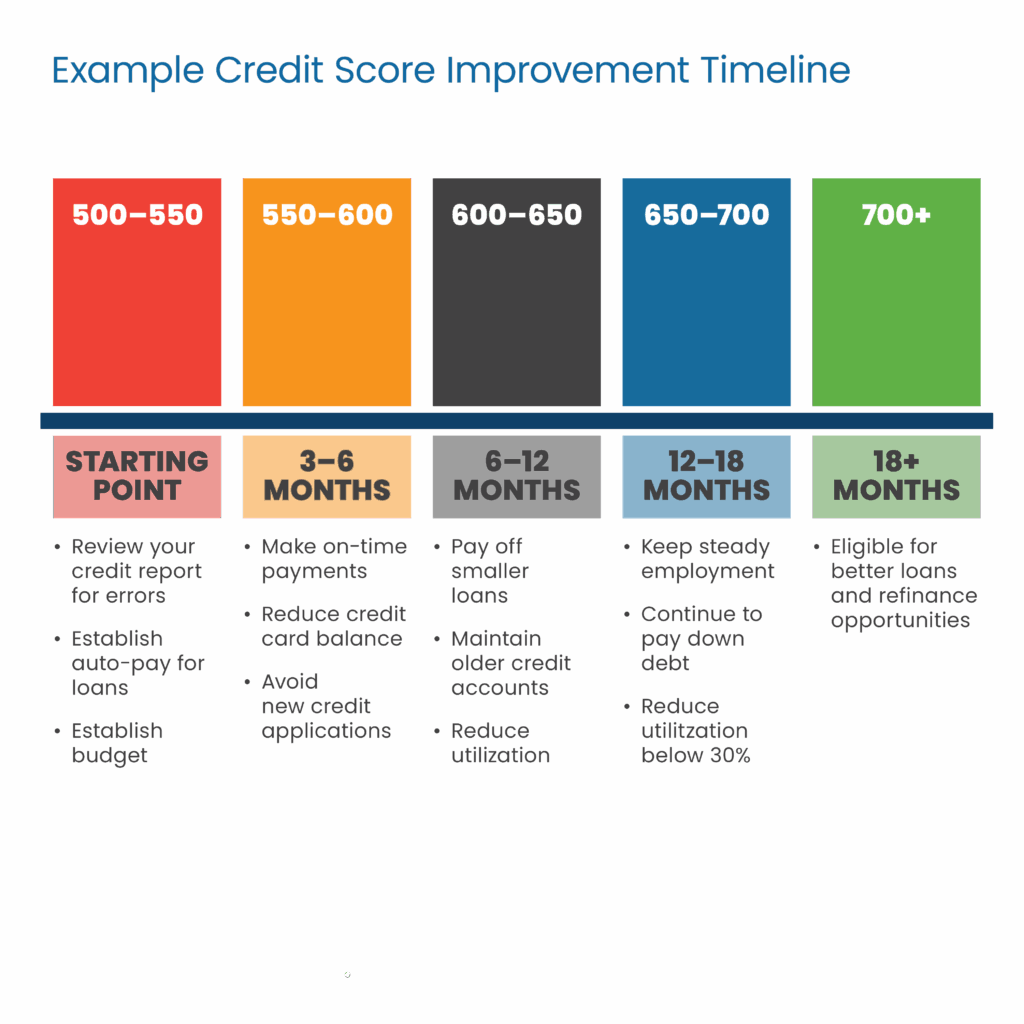

Rebuilding Credit from 500 to 700+

Rebuilding your credit score can take time, but it’s a critical effort in building a stronger financial future. Small changes (like timely bill pay) or larger efforts (like paying off an entire loan) can result in meaningful improvements. Review the checklist below to explore which actions you can do right now to work toward a 700+ score:

- Pay Bills On Time: This has a major impact on your credit score and can be achieved through careful monthly planning. Consider an auto-pay system if you are struggling to remember payment dates.

- Lower Credit Utilization: Track how much spending is put on credit cards and try to keep overall usage below 30%. High credit usage (also called utilization) can negatively affect your credit score.

- Avoid Hard Inquiries: Hard credit checks can temporarily lower your score; if possible, stick to soft credit checks until your score improves.

- Lower Debt: Work to pay off loans whenever possible. While some recommend targeting loans with the highest interest rates first, you can also pay off loans with smaller balances to remove them from your credit report.

Rebuilding from 500 to 700+ takes time, but by practicing responsible credit habits and managing debt, a higher credit score can be obtained! These actions not only raise your credit score but also expand your refinancing and consolidation options.

How Yrefy Can Help

There is a lot to consider when trying to refinance or consolidate loans, especially if you have low credit. Terms, options and planning can feel overwhelming, but you don’t have to navigate this process alone.

Yrefy works with borrowers and co-borrowers who have delinquent or defaulted private student loans, including those with low credit and complicated financial histories. For eligible borrowers, we offer fixed-rate refinancing, custom repayment plans and, in some cases, co-borrower release.

Want to have a conversation with our team and learn more? Apply online here or call us at (888) 358-3359.

Disclaimer: Yrefy is not a credit repair company. Results vary by borrower.