Financial Wellness: More Than Just Numbers

Do financial worries keep you up at night? You’re not alone. According to the American Psychological Association, 82% of people aged 18 to 34 years cited money problems as a significant source of tension in their life.[1]

But here’s the good news: financial wellness isn’t dependent on being wealthy; it’s about being in control of your finances and knowing where the money goes.

What Does Financial Wellness Really Mean?

Financial wellness goes beyond just having enough to get by. It’s about feeling secure, in control, and free to make financial choices without constant money anxiety. You should be living your life to the fullest without the constant worry of bills, debt, and the unknown. If you’re not, that’s okay too. You can change your future by taking small actions today.

Financial wellness is your personal GPS for money decisions. It’s not about reaching a final destination, but about building the skills and habits that keep you moving in the right direction, no matter where you’re starting from.

The 5 Pillars of Financial Wellness:

- Budgeting

- Saving

- Debt Management

- Investing

- Financial Literacy

These 5 pillars are your foundation for making smart money moves, and setting yourself up for long term success. We will dive into each one below, with a recommended resource for each.

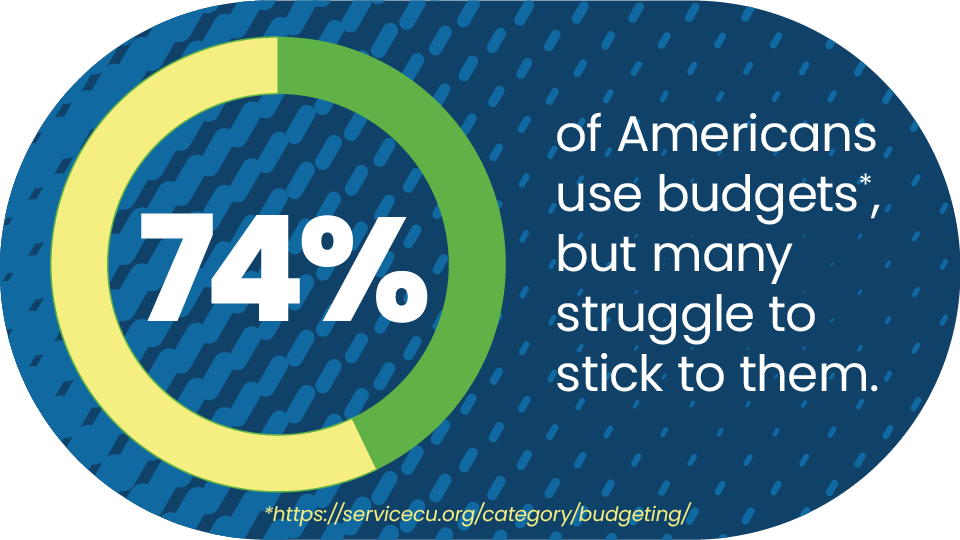

- Budgeting: Protect Your Future

Knowing where your money goes is the first step to taking control. Create a budget that reflects your income and expenses and stick to it as much as possible. Learn more about budgeting.

We recommend embracing the 50/30/20 rule as a starting point for any budget.

- 50% for needs (rent, groceries, minimum loan payments)

- 30% for wants (dining out, entertainment, hobbies)

- 20% for savings and extra debt payments

For example, with a $4,000 monthly after-tax income:

- $2,000 will go to needs

- $1,200 can go towards wants

- $800 is for savings and additional debt repayment

“Financial freedom is not the ability to purchase everything you want, it’s the ability to live the life you want without worrying about money.” -Suze Orman

- Saving: Create Your Financial Safety Net

The reality is that as of 2024, according to the Federal Reserve, 37% of adults are unable to cover a $400 emergency without borrowing money.[2]

It’s important to not let yourself become part of that statistic. Without savings, even a minor emergency can become a huge financial setback, forcing reliance on credit cards or loans. The amount you need in your personal emergency fund entirely depends on you and your comfort level. Experts recommend starting with just $1,000 and then working on saving a total of six months of expenses.

Make saving a habit, even if it’s just a small amount each month. Building an emergency fund and saving for specific goals, like retirement or a dream vacation, will give you peace of mind and financial security.

At Yrefy we recommend:

- Starting with just $25-50 per month (seriously, that’s less than most streaming subscriptions). We suggest that you automate your savings, so it goes into your account before you spend it. Pay yourself first!

- Building to $1,000 in your starter emergency fund

- And gradually working towards having 3-6 months of expenses in your savings account

“Don’t buy things you can’t afford, with money you don’t have, to impress people you don’t like.” – Dave Ramsey

- Debt Management: Break Free from the Burden

Debt can be a burden, but it’s not a life sentence. When you develop a plan to pay off your debts, prioritize high-interest ones first, and avoid unnecessary borrowing, you’ll soon find yourself out of the debt trap.

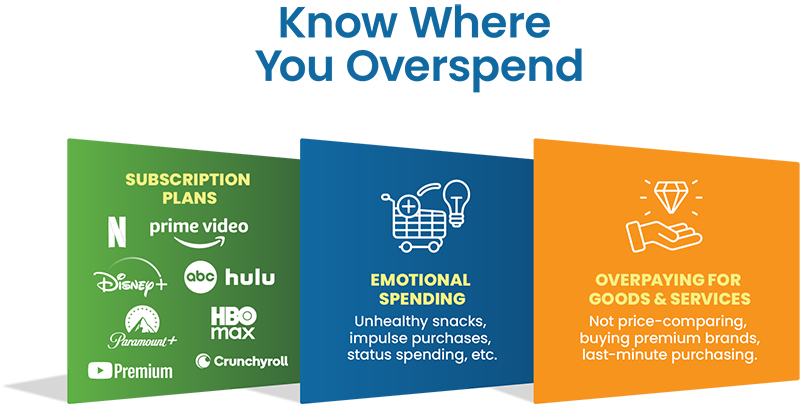

Keeping track of your expenses is the first step to getting out of debt. You need to know where your money goes, so you can plug up the “leaks” in your bank account. Two very common traps people find themselves falling into are emotional spending and overpaying for goods and services.

One common trap people fall into is emotional spending, including purchases of unhealthy snacks, impulse buys, and status spending. Another root cause of money mismanagement is overpaying for goods and services. This includes not price-comparing, buying premium brands, and last-minute shopping. Paying for subscriptions you don’t use is another version of overpaying.

Common money leaks to plug:

- Emotional spending: Those late-night online shopping sprees when you’re stressed

- Subscription creep: Paying for services you forgot you had

- Brand loyalty tax: Buying premium products without comparing prices

- Convenience costs: Last-minute shopping and impulse purchases

Two common strategies to incorporate into your debt payoff plan:

- Avalanche method: Pay minimums on all debts, throw extra money at the highest interest rate debt first

Snowball method: Pay minimums on all debts, focus extra payments on the smallest balance first (great for motivation)

| Loan | Balance | APR | Term | Monthly Payment | Total Interest Paid |

|---|---|---|---|---|---|

| Federal Student Loan | $32,000 | 5.50% | 120 months / 10 years | $347.28 | $9,673.60 |

| Private Student Loan | $15,000 | 18.35% | 120 months / 10 years | $273.67 | $17,840.40 |

| Auto Loan | $22,000 | 4.50% | 60 months / 5 years | $410.15 | $2,609.00 |

| Credit Card 1 | $3,200 | 23.24% | 120 months / 10 years (assumed payoff horizon) | $68.87 | $5,064.40 |

| Credit Card 2 | $9,500 | 16.73% | 120 months / 10 years (assumed payoff horizon) | $163.49 | $10,118.80 |

- Pay only the minimums each month: ~$1,263.

- No extra applied.

- Time to pay off: ~10 years.

- Total Interest Paid: $45,306.20

- Total Repaid – Principal and Interest: $127,006.20

Example – Debt Snowball:

| Loan | Balance | APR | NEW Payment Length | Monthly Payment | NEW - Total Interest Paid |

|---|---|---|---|---|---|

| Federal Student Loan | $32,000 | 5.50% | 78 months / ~6.5 years | $347.28 | $7,555.84 |

| Private Student Loan | $15,000 | 18.35% | 44 months / ~3.7 years | $273.67 | $7,517.73 |

| Auto Loan | $22,000 | 4.50% | 52 months / ~4.3 years | $410.15 | $2,501.19 |

| Credit Card 1 | $3,200 | 23.24% | 7 months | $68.87 | $220.87 |

| Credit Card 2 | $9,500 | 16.73% | 23 months / ~2 years | $163.49 | $2,031.81 |

- Focus on paying off the smallest balance (Credit Card 1) first, then roll that payment into the next debt.

- Payment order: Credit Card 1 → Credit Card 2 → Private Student Loan → Auto Loan → Federal Student Loan.

- Credit Card 1 ($3,200 @ 23.24%) → Paid off in 7 months

- Credit Card 2 ($9,500 @ 16.73%) → Paid off in 23 months

- Private Student Loan ($15,000 @ 18.35%) → Paid off in 44 months

- Auto Loan ($22,000 @ 4.50%) → Paid off in 52 months

- Federal Student Loan ($32,000 @ 5.50%) → Paid off in 78 months (~6.5 years)

- Total payment each month: $1,671.40.

- $500 monthly extra applied.

- Time to pay off: ~6.5 years.

- Total Interest Paid: $19,827.44

- Total Repaid – Principal and Interest: $101,527.44

- Payment order: Credit Card 1 → Credit Card 2 → Private Student Loan → Auto Loan → Federal Student Loan.

Example – Debt Avalanche:

| Loan | Balance | APR | NEW Payment Length | Monthly Payment | NEW - Total Interest Paid |

|---|---|---|---|---|---|

| Federal Student Loan | $32,000 | 5.50% | 73 months / 6.1 years | $347.28 | $7,035.78 |

| Private Student Loan | $15,000 | 18.35% | 30 months / 2.5 years | $273.67 | $4,381.59 |

| Auto Loan | $22,000 | 4.50% | 60 months / 5 years | $410.15 | $2,609.00 |

| Credit Card 1 | $3,200 | 23.24% | 7 months | $68.87 | $220.87 |

| Credit Card 2 | $9,500 | 16.73% | 44 months / 3.7 years | $163.49 | $4,654.33 |

- Focus on paying off the balance with the highest APR first, then roll that payment into the next debt.

- Payment order: Credit Card 1 → Private Student Loan → Credit Card 2 → Auto Loan → Federal Student Loan.

- Credit Card 1 ($3,200 @ 23.24%) → Paid off in 7 months

- Private Student Loan ($15,000 @ 18.35%) → Paid off in 30 months

- Credit Card 2 ($9,500 @ 16.73%) → Paid off in 44 months

- Auto Loan ($22,000 @ 4.50%) → Paid off in 60 months

- Federal Student Loan ($32,000 @ 5.50%) → Paid off in 73 months

- Total payment each month: $1,671.40.

- $500 monthly extra applied.

- Time to pay off: ~6 years.

- Total Interest Paid: $18,901.57

- Total Repaid – Principal and Interest: $100,601.57

- Payment order: Credit Card 1 → Private Student Loan → Credit Card 2 → Auto Loan → Federal Student Loan.

“Wealth is not about having a lot of money; it’s about having enough.” – Pablo Picasso

- Investing: Make Your Money Work for You

Don’t let your money sit idle. Learn about different investment options and choose ones that align with your risk tolerance and goals. You don’t need thousands to start investing… Thanks to compounding interest, even small investments can grow over time and contribute to your financial future.

Even if you can’t fully invest in the way you want to right now, at the very minimum, you should have both a high-interest checking and a savings account.

Start here:

- If your employer offers a 401(k) match, contribute enough to get the full match (it’s free money!)

- Consider low-cost index funds for beginners

- Use apps like Acorns or Stash to start small with spare change

“The philosophy of the rich and the poor is this: the rich invest their money and spend what is left. The poor spend their money and invest what is left.” – Robert Kiyosaki

- Financial Literacy: The Secret Weapon

Knowledge is power. Educate yourself about personal finance, from basic budgeting skills to understanding taxes and retirement plans. The more you know, the better equipped you are to make informed decisions.

Level up your money IQ:

- Follow reputable financial blogs and podcasts

- Understand your employee benefits (many people leave money on the table)

- Learn the basics of taxes and retirement accounts

Stay informed about your student loan options and repayment strategies

“one of the most powerful ways to increase your savings isn’t to raise your income. It’s to raise your humility.” –

Financial wellness is a deeply personal journey – it will not look like your friend’s or your co-worker’s, and that’s okay. It’s not about comparing yourself to others or keeping up with the Joneses. It’s about finding what works for you and making steady progress towards your goals.

Here’s how to stay on track:

- Check-in with Yourself Regularly: Schedule 30 minutes each month to review your budget and financial goals. What’s working? What needs adjustment? Celebrate your wins (no matter how small) and don’t be discouraged by setbacks.

- Get Support: Don’t be afraid to ask for help from a trusted financial advisor or counselor. An outside perspective can help you see any missed opportunities.

- Re-frame Your Mindset: Money shouldn’t be a source of stress and anxiety. Focus on the positive aspects of financial wellness, such as the freedom and choices it gives you. Instead of saying to yourself, “I can’t afford it,” try “It’s not a priority right now.” This shift helps you feel empowered rather than deprived.

- Start Imperfectly: Don’t wait until you have everything figured out. Take one small action today—set up automatic savings, track expenses for a week, or research your 401(k) options.

Financial wellness is not perfection or just about having more money. It’s about feeling empowered, secure, and in control of your financial future. By taking small steps and making smart choices today, you can create a bright financial future for yourself and your loved ones.

Whether you’re tackling student loans, saving for a house, or just trying to stop living paycheck to paycheck, every small step matters. Your future self will thank you for starting today.