How to Refinance Student Loans Without a Degree

Can You Refinance Student Loans Without a Degree?

The answer is: sometimes, but it depends on the lender.

If you are looking to refinance without a degree, you still have options. Many borrowers assume that not having a degree disqualifies them from refinancing their private student loans. That’s not always accurate.

While it’s true that traditional lenders (like banks) might have a degree requirement, it’s not a universal rule. Refinancing without a degree may be more difficult, but it’s not impossible!

To better understand this process and your options for refinancing without a degree, it’s important to understand why some lenders may care about graduation.

Why Many Lenders Require Graduation

Lenders want to limit risk, so they often use underwriting models (frameworks for assessing risk) to review a borrower’s application and determine if they can meet their loan repayment obligations.

From the lender’s perspective, graduation is an indicator of a higher likelihood of stable employment, future earning potential, and the ability to meet long-term repayment obligations. As a result, many lenders include graduation as a hard eligibility requirement. This means that applicants without a completed degree might be declined. This process is simply a risk filter that many financial institutions use to protect their interests.

The Logic Behind Degree Requirements

Traditional lenders value and prioritize predictability. An applicant who leaves school without a degree may have a less predictable earning potential compared to a degree-holding candidate. However, that does not mean an applicant without a degree will perform worse in the job market; it simply means that the models used by traditional lenders to assess applicants often view degree-holders as less risky borrowers.

While this process may be logical, it often excludes borrowers who left school early for valid and important reasons, often relating to financial, medical, or personal issues. Unfortunately, this means borrowers who are otherwise financially stable and can meet their repayment obligations may not be considered for refinancing because they have not completed their degree.

Which Lenders Allow Refinancing Without a Degree?

While some lenders may require borrowers to have graduated, other lenders take a more flexible approach. These lenders look beyond a borrower’s graduation status and focus on their overall financial picture instead.

Nontraditional Lenders

Nontraditional lenders may employ an alternative underwriting model that places greater emphasis on factors such as income consistency, employment history, and payment behavior, rather than education. Rather than disqualifying a borrower without a degree, these lenders assess if a borrower can realistically manage a refinanced loan payment based on their current circumstances.

Mission-Based Lenders

Some lenders may focus on serving a specific mission, which can include expanding access to credit for borrowers who don’t fit a traditional profile. These lenders may be more interested in a borrower’s personal background and circumstances (such as religion, demographics, region, and life experience) than whether they hold a degree.

While specific standards still apply, mission-based lenders may be more willing to work with individuals who have experienced educational disruptions but can still meet their repayment obligations.

Community-Based Refinancing Options

Local credit unions and community-based institutions may offer refinancing options with more personalized underwriting. Because decisions are sometimes made locally rather than through an automated system, borrowers without a degree may have a better chance at explaining their situation and demonstrating financial stability.

That said, availability and flexibility can vary widely by institution.

Where Yrefy Fits In

Yrefy is not a traditional lender, and we do not require borrowers to have a degree to refinance their private student loans.

Our refinance requirements are more flexible, as we consider a borrower’s full financial profile. We specialize in helping borrowers with low credit and defaulted private student loans.

If you don’t meet traditional lender requirements, Yrefy may be able to help with private student loan refinancing. Read to the end to learn more.

What You Need to Qualify Without a Degree

When a lender does not require graduation, the focus shifts toward whether a borrower can realistically repay their loan based on their current financial situation. While exact requirements will vary by lender, most will look for the following factors:

- Income stability: Consistent income is one of the most important qualifiers. Lenders typically want to see reliable earnings over time, whether from a salaried job or contract work (such as delivering food orders on the weekends).

- Credit requirements: Credit score and credit history are important, but some lenders may be more flexible with past delinquencies or credit issues, especially if recent payment behavior is consistent.

- Employment: Steady employment is critical, as it demonstrates repayment ability.

- Debt-to-income ratio (DTI): DTI measures how much of a borrower’s monthly income goes toward debt payments. A lower ratio generally means a higher chance of approval and better loan terms, even without a degree.

Meeting these criteria does not guarantee approval, but strengthening them can significantly improve the chances of qualifying with a lender that offers flexible underwriting.

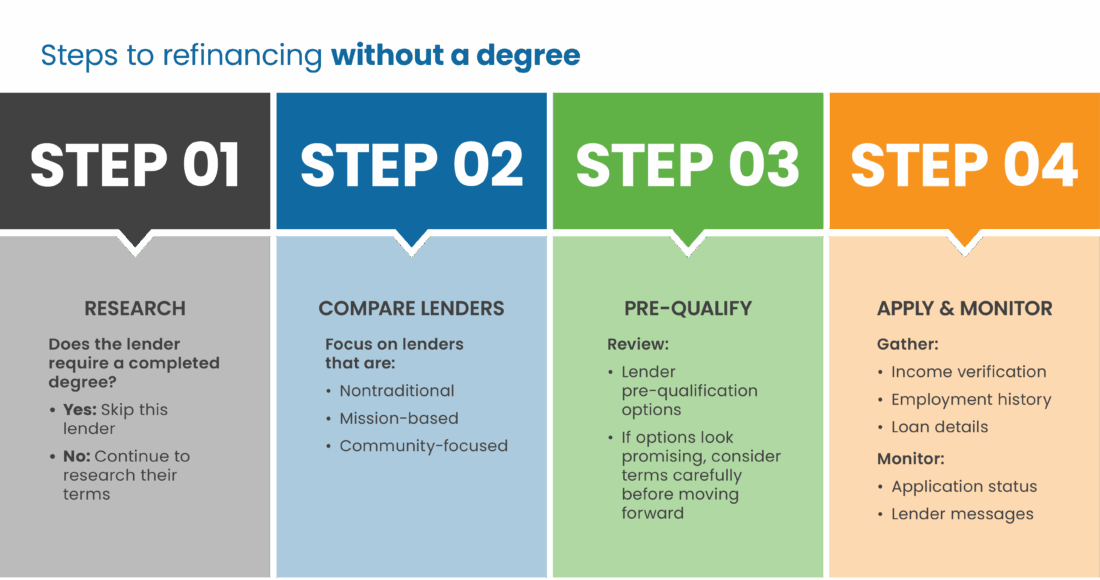

Step-by-Step: How to Refinance Loans If You Didn’t Graduate

Refinancing without a degree requires a slightly more strategic approach. Consider the steps below to avoid unnecessary denials and negative credit impacts.

Step 1: Confirm early if a lender you are interested in working with requires a degree. If a completed degree is listed as a hard requirement, applying likely isn’t worth it and may result in a pointless credit inquiry (which can lower your credit score).

Step 2: Compare lenders and focus on the ones with more flexible underwriting models. Non-traditional, mission-based, and community-focused lenders may be more willing to look at a borrower’s full financial profile rather than relying solely on educational history.

Step 3: Once a lender has been found, review their pre-qualification options to determine if a refinance is possible. This is very important, as it allows a borrower to explore a lender’s programs and terms without submitting a full application (and possibly receiving a credit inquiry). If the refinance options seem promising, review all terms carefully before moving forward.

Step 4: Before officially applying, gather the necessary documentation, including proof of income, employment history, and loan details. Submitting a complete and accurate application can help improve the chances of approval, and if approved, limit the need for additional applications.

As a best practice, once your application is submitted, monitor it for updates and be responsive to lenders who may require additional details. Before moving forward with any offer, it’s critical to read the entire loan agreement and confirm all terms in writing.

What to Do If You Don’t Qualify

If denied refinancing, it usually means certain parts of your financial profile need to be strengthened first.

Improving your credit score is often the most effective first step. Making consistent on-time payments and reducing balances (such as credit card debt) can gradually strengthen your profile and improve future approval odds.

Some borrowers may also want to consider adding a co-borrower with strong credit and a stable income to their refinance application. While this can help with approval, it also places shared responsibility on the co-borrower. They should be fully aware of their legal and financial obligations.

If refinancing remains difficult, borrowers should also pursue lower payment options through temporary hardship programs or alternative repayment arrangements. These arrangements vary by lender and may require meeting certain requirements or may not be offered at all.

In limited cases, some borrowers may consider settlement. It’s important to understand that settlement is a non-standard and often difficult process. Settlements are typically considered a last resort. Our Yrefy team has covered settlement options for both private and federal student loans on our blog.

Even if refinancing is not currently an option, it may become available in the future as income, credit, or employment improves.

Is Refinancing the Best Choice Without a Degree?

Refinancing without a degree can make sense for some borrowers, but it isn’t the right solution in every situation. The following pros and cons can help borrowers evaluate whether refinancing is right for them.

Pros and Cons

The pros of refinancing may include:

- Lower interest rates.

- The opportunity to remove a loan from delinquent or defaulted status.

- Converting a variable interest rate loan into a fixed interest rate loan.

The cons of refinancing may include:

- Approval and terms may depend on income and credit history.

- Limited lender availability for borrowers without a completed degree.

- Potential loss of federal protections if federal loans are refinanced into private loans.

Why Refinancing is Typically Better Than Settlement

Refinancing is a fairly standard process that keeps a loan in good standing through structured repayment over time. In contrast, settlement is typically associated with default and can negatively affect a borrower’s credit, along with creating possible tax consequences. If refinancing is available, it is generally the more stable option for long-term financial health than a settlement.

Final Thoughts + Next Steps

Not finishing a degree does not eliminate your refinance options. If you have private student loans and do not meet traditional refinancing requirements, Yrefy may be able to help.

Yrefy is not a traditional lender. We consider more than just your degree status when determining eligibility. We’ve helped countless borrowers lower their monthly payments and save thousands. We have the testimonials to prove it.

Get in touch with us at (888) 358-3359, or fill out our contact form, and a member of our team will reach out to you.