How to Refinance Student Loans for Doctors and Dentists

What Is Medical Student Loan Refinancing?

For doctors and dentists, student loans are often a major source of financial stress. Attending medical or dental school often comes with a high price tag. This leaves many graduates with large balances before they reach their peak earning years.

However, there is good news: refinancing medical student loans can, in the right circumstances, reduce interest costs and simplify repayment in the future.

How Refinancing Works

Student loan refinancing is the process of replacing one or more existing loans with a new loan, ideally with a lower interest rate, better repayment terms, or both. The new lender pays off the existing loan(s), and the borrower makes a new monthly payment (under new terms) to their new lender.

While the process itself is relatively simple, refinancing is not automatically the right move for every doctor or dentist.

Differences for Doctors and Dentists

Doctors and dentists often graduate with exceptionally high student loan balances while earning relatively modest income during training, such as residency or fellowship. As of 2025, the average debt for medical and dental school students exceeds $200,000. This creates a high debt-to-income ratio (DTI) early in a medical career, despite the strong long-term earning potential.

Because of this, during the refinance process, lenders will often look at other factors such as specialty, training status, and expected future earnings alongside credit history, loan balance, and DTI. This approach reflects the unique career trajectories of doctors and dentists, whose incomes often increase substantially over time.

Should You Refinance Medical School Loans?

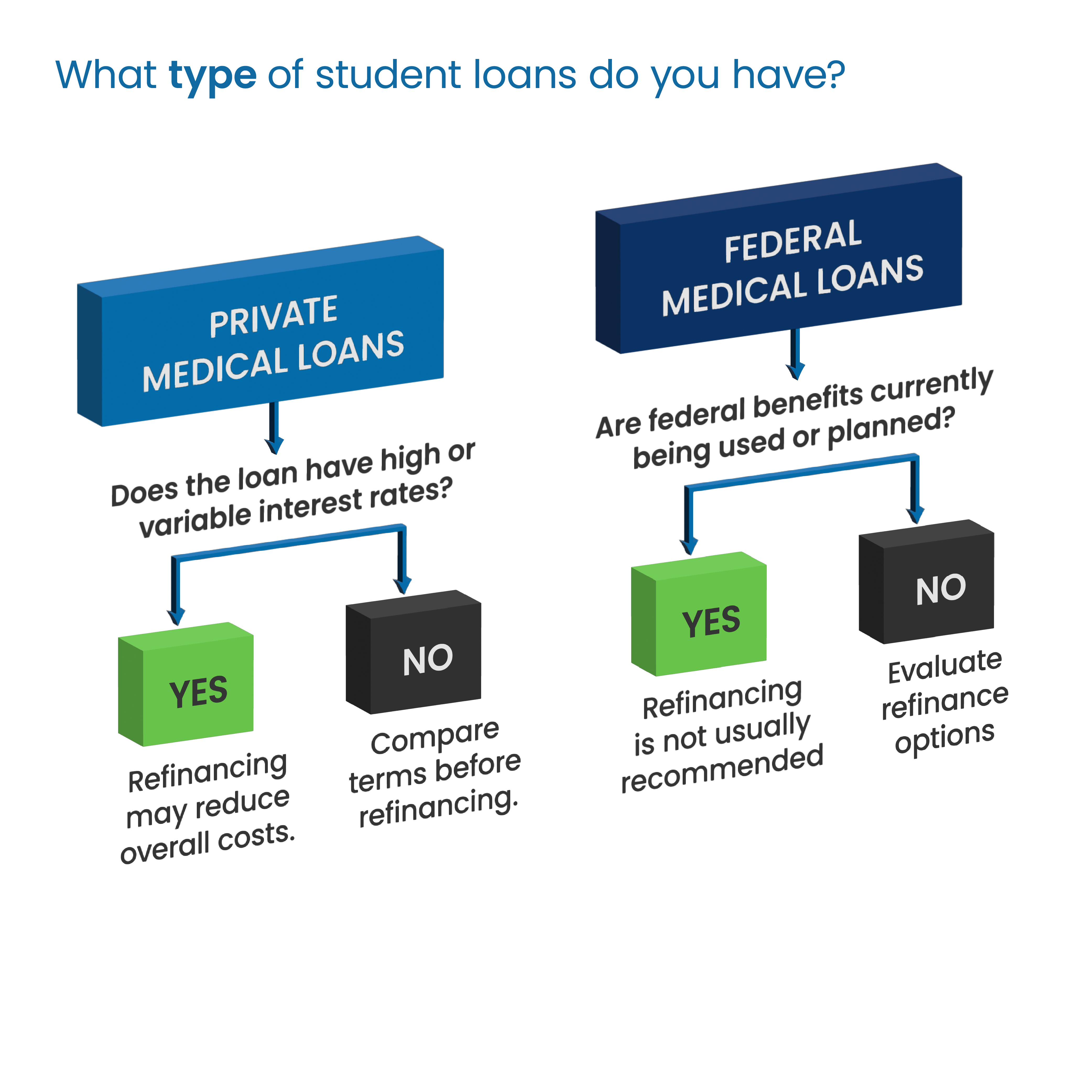

Refinancing medical school loans can make sense for some medical professionals, but it often depends on the type of loan, income stability, and whether the borrower relies on federal programs.

When It’s Smart

Refinancing private loans can be a smart financial move for doctors and dentists once their income has stabilized, or if their loans have high or variable interest rates. Because medical school balances are often large, even a small reduction in interest rates can meaningfully reduce total repayment costs.

For doctors and dentists with federal medical loans, refinancing requires a more thorough evaluation.

When It’s a Bad Idea

Refinancing is not typically a good idea for borrowers using federal income-driven repayment plans or those who expect to receive Public Service Loan Forgiveness. Converting federal loans into a private loan permanently removes access to federal repayment, hardship, and often forgiveness programs.

Refinancing during residency or fellowship could also result in loan terms or interest rates that are less favorable due to lower income. In many cases, delaying refinancing until income increases provides greater flexibility and improved loan options.

When to Refinance: Residency vs Attending Salary

Timing is one of the most important factors in medical student loan refinancing. While some borrowers may want to refinance during residency, many see better options after income increases.

Pros and Cons of Refinancing During Residency

Refinancing during residency may be appealing for borrowers with private student loans and high interest rates. In some cases, refinancing can lower rates modestly or consolidate multiple loans into a single payment.

However, there are meaningful cons. Resident income is typically much lower than attending income, which may limit access to competitive rates. Refinancing federal loans at this stage may also remove access to income-driven repayment plans and other federal protections that are often most valuable during training. Once refinanced, those benefits cannot be restored.

Benefits of Waiting Until Attending Salary

Waiting to refinance until income increases often provides greater flexibility and stronger negotiating power. Attending-level income generally improves creditworthiness in the eyes of lenders, leading to lower interest rates and more favorable loan terms.

As illustrated in the comparison table below, even small rate differences can translate into significant interest savings over time when applied to large medical school loan balances.

Rate Differences After Income Increases

The table below includes an example of how interest rate offers from lenders may improve depending on career stage. The example assumes a $300,000 balance with a 10-year repayment term and a starting fixed interest rate of 7%.

Residency vs Attending: Interest Cost Comparison

$300,000 balance | 10-year term | Fixed interest rate

| Scenario | Interest Rate | Total Interest Paid |

|---|---|---|

| No Refinancing | 7.00% | $120,000 |

| Refinancing During Residency | 6.00% | $100,000 |

| Refinance as Attending | 4.50% | $75,000 |

How to Refinance Medical School Loans Step-by-Step

So, how does the refinance process actually work? It’s fairly straightforward.

Step 1: Review credit and income: Start by assessing your credit profile, current income, and overall debt-to-income ratio. For doctors and dentists, lenders may also want to know training status and career specialty.

Step 2: Prequalify with multiple lenders: Prequalification typically involves a soft credit check and provides estimated rates. This allows you to compare offers before committing to a full application (and likely a hard credit inquiry).

Step 3: Compare lenders and loan terms: Evaluate interest rates alongside repayment terms, fees, hardship options, and any medical career benefits that may apply.

Step 4: Consider co-signers and term length: A co-signer may improve eligibility or rates, but shared responsibility should be carefully weighed and communicated. Finally, consider a repayment term, typically between five and twenty years, that balances monthly affordability with total interest cost.

Pros and Cons of Refinancing for Medical Professionals

Refinancing student loans can be beneficial for doctors and dentists, but it is highly dependent on loan type, career stage, and long-term plans. Understanding the pros and cons is critical before moving forward.

Pros of Refinancing

For borrowers with private student loans, refinancing may reduce interest costs, particularly once income has increased after training. Refinancing can also consolidate multiple loans into a single monthly payment, which may simplify monthly repayment.

Following training, a higher and more stable income can lead to better lender offers, such as low fixed rates or more favorable repayment terms that may not have been previously available.

Cons of Refinancing

The most significant drawbacks arise when federal student loans are refinanced.

Converting federal loans into a private loan may permanently eliminate access to income-driven repayment plans, federal forbearance options, and forgiveness programs, such as the Public Service Loan Forgiveness program. For many doctors and dentists, these federal programs provide crucial financial support during years when income is modest.

Refinancing too early can also be an issue. Locking into a private loan refinance before personal finances stabilize or before all options are considered can reduce flexibility.

When Yrefy May Be an Option

If you have private student loans or don’t meet traditional lender requirements, Yrefy may be able to help!

Unlike some traditional lenders, Yrefy considers more than just a borrower’s credit score or career status. We review a borrower’s full financial profile and specialize in helping qualified borrowers refinance their defaulted or delinquent private student loans.

For qualified doctors or dentists with private student loan debt, Yrefy may be able to help secure a low, fixed-interest rate loan that can help save thousands.

Want to speak with our team and explore your options? Apply online or call us at (888) 358-3359.

Final Thoughts

Refinancing medical student loans can be a powerful financial tool, but it is not a decision that should be rushed. For doctors and dentists, the right approach often depends on timing, loan type, and long-term career plans. In many cases, waiting until income stabilizes opens the door to better rates and terms.

Whether refinancing makes sense now or later, a critical step is understanding the tradeoffs. Refinancing private loans may reduce interest costs, while refinancing federal loans requires careful consideration due to the potential permanent loss of federal protections. Taking the time to weigh these factors can help avoid decisions that may be irreversible.

A Medical Student Loan Refinancing Checklist

Before moving forward, consider the following:

- What type of loans are involved (federal, private, or both).

- Whether federal repayment or forgiveness programs are being used or planned.

- Current income levels and expected changes after training.

- Credit profile and overall debt-to-income ratio.

- Current interest rates and terms available today compared to future options.

A thoughtful, well-timed decision can make repayment more manageable and potentially reduce overall student loan repayment costs.

Disclaimer: This article is for informational purposes only and should not be considered legal advice. Always consult with a qualified attorney or financial professional regarding your specific situation.