Buying a Home with Student Loan Debt

Many Americans, emerging into the workforce with an average of nearly $40,000 of

student loan debt, find themselves spinning their wheels and going nowhere fast. Paying for

education is such a monumental task that other major life purchases: cars, houses, even having

children, are postponed.

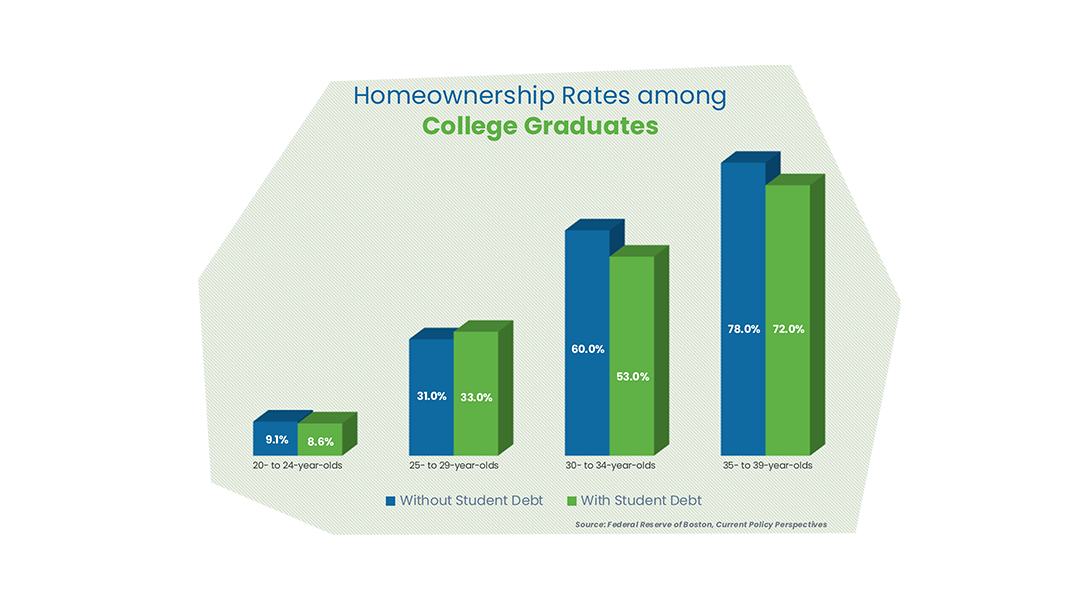

The Education Data Initiative found a 5.8% decline in homeownership between 2005

and 2014. In that same period, the rate of homeownership among recent graduates ages 24 to 32,

fell 20.0%. Meanwhile, student loan debt doubled among the same demographic. Experts

attribute up to 20% of the decline in homeownership in the 24 to 32 year-old age bracket to

drastically increased student loan debt.

For every $1,000 increase in student loan debt, homeownership among young college

graduates (ages 35 and under) drops an average of 1.8%. Two large barriers to homeownership

arise for individuals paying off student debt: High Debt to Income Ratios (DTI) and Low

Credit Scores disqualify many Borrowers from mortgages. Moreover, 47% of Borrowers say

their debt prevented them from affording a down payment on a home. Affording a down

payment is an obvious issue, and buying a home without taking out a mortgage is completely out

of the question for the average would-be homeowner.

I. DEBT TO INCOME RATIO

The U.S. Consumer Finance Protection Bureau suggests that a 36% or lower DTI is

optimal to qualify for competitive mortgages, with the upper limit to qualify being 43%. For

young adults paying off student loans, this is often not achievable. 45% of Borrowers say their

high DTI prevented them from qualifying for a mortgage.

II. CREDIT SCORE

Credit scores can be seriously impacted by student loan debt. High amounts of debt lower

scores, as does missing a payment or defaulting. On the other hand, on-time payments can

improve scores.

- 72% of Borrowers believed their debt would delay their home purchasing

- 33% of people who have or had student loan debt & make less than $50,000/year say

student loan debt affected their decision to purchase a home. - 33% of people who have or had student loan debt & make under $50,000/ year say

student loan debt prevented them from buying a home

If you are like many Americans grappling with student debt, you have options. Borrowers

with student loan debt are more likely to qualify for federally backed loans than conventional

mortgages taken out from banks, credit unions, etc. These include a few varieties, like:

- FHA loans

- USDA home loans

- VA loans

III. FHA HOME LOANS

Home loans through the Federal Housing Administration typically accept DTIs up to

50% and Credit scores of 580 for a 3.5% down or as low as 500 with a 10% down. FHA loans

are granted by private lenders but backed by the federal government to help lower-income

Americans buy homes. Sometimes the buyer can also use grants for their down payment.

IV. USDA HOME LOANS

The U.S. Department of Agriculture offers mortgages to low-income Buyers in rural

areas who do not qualify for conventional loans. USDA loans are either insured by the

department and granted through private Lenders or granted directly from the government.

In both cases, Borrowers pay 0% down and pay a fixed interest rate for at least 30 years.

The program accepts Borrowers with up to a 41% DTI (or higher in some extenuating

circumstances) and no minimum credit score.

V. VA LOANS

Veterans, active service members, and their spouses are eligible for a home loan through

the Department of Veterans Affairs. VA loans can be used to build or renovate homes or finance

up to 100% of the purchase of a new home. Borrowers are eligible for a 0% down and there are

no strict credit minimums to qualify.

VI. OTHER ASSISTANCE PROGRAMS

Federal and state legislatures have enacted several programs in an attempt to assist

graduates with debt in buying homes. Most notably, the Federal Transforming Student Debt to

Home Equity Act of 2022 gives homebuyers with student debt perks including mortgages at

lower rates and financial assistance for down payments. In states like Maryland, Rhode Island,

and Ohio, grant programs have been established to assist buyers by contributing to a down

payment and even assisting with existing student debt.

Perhaps the easiest way to work toward homeownership is to organize your student debt

before taking on additional loans on a home. Loan consolidation and refinance are feasible

options to tackle overwhelming student debt. Refinance can even be a tool to increase your credit

and qualify for a more competitive mortgage. In a lot of cases, your best plan of action might be

paying down a portion of student loan debt before considering homeownership.