America’s Student Debt Crisis is Fueling a Health Emergency

Student debt in the United States has reached a breaking point.

As of 2025, 42.5 million Americans have some form of student loan debt, owing a staggering total of $1.797 trillion (Caporal, 2025). The average debt per borrower, including federal and private loans, is $41,618 (Hanson, 2025).

For many, these numbers aren’t just statistics – they are ever-present, daily, real burdens.

This financial weight can often bleed into every corner of someone’s life – especially mental health. In fact, 91% of young adults are so stressed about money that they say that it’s impacting their physical and mental wellness (Moyer, 2023). Harvard reported that: “those with consistently high debt ‘report 21 percent higher depressive symptoms than respondents who report no or low debt across the life course’.” They also went on to say:

In fact they went on further to explain the results of a study: ‘[They] examined the association between student loans and psychological functioning for currently enrolled students and those between ages 25 and 31. They conclude that for both groups, ‘student loans are associated with poorer psychological functioning.’ They say: ‘This association is seen both for the cumulative amount of student loans borrowed across the course of schooling, as well as for the yearly amount of student loans borrowed while in college.’” (Robinson, 2023).

Not only is student loan debt causing both depression and a cognitive toll on America’s young people, it also has the potential to become deadly. An ELVTR study found that 54% of borrowers’ mental health struggles are linked to their student loans. Among 2,000 respondents aged 18-67, 1 in 14 reported that they had suicidal thoughts linked to their loans. For those making less than $50,000 per year, that number jumped to 1 in 8.

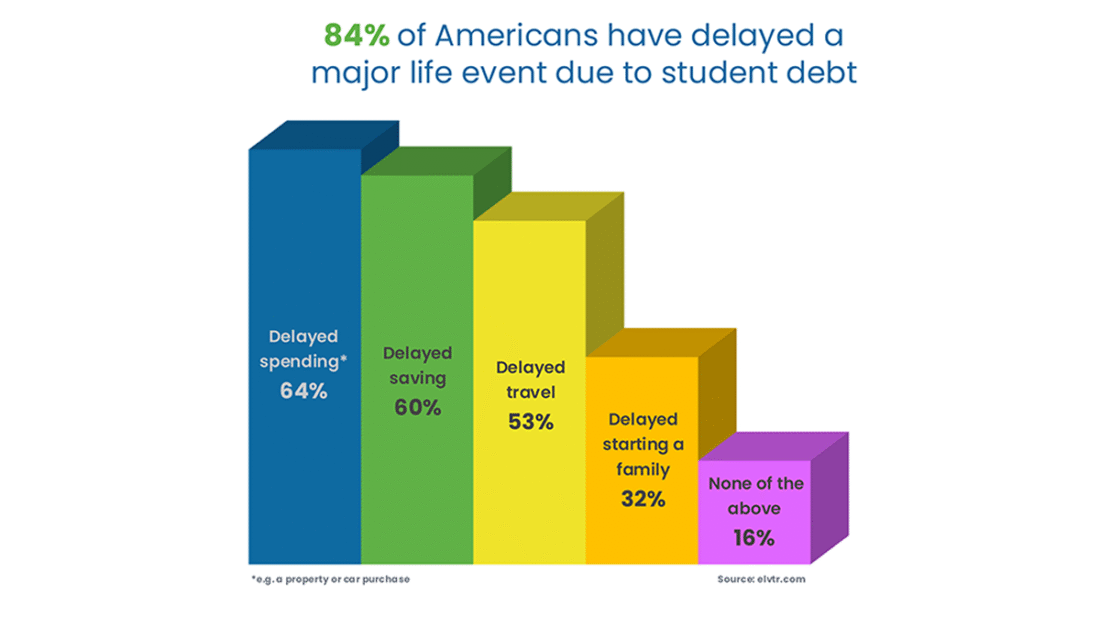

Debt creates a paralyzing cycle: feelings of hopelessness, stalled goals, and no way out. The pressure is so intense that borrowers often delay home purchases, savings, starting families, and other major life milestones. In the ELVTR survey, they found that this is the case with 84% of people (ELVTR Magazine, 2023).

But it’s not only mental health that’s failing in America’s young adult community; it’s physical health as well. Harvard explained: “Debt is a problem for our health and well-being, it is because it’s this noxious, chronic stressor that over long periods of time can cause health problems….” (Robinson, 2023).

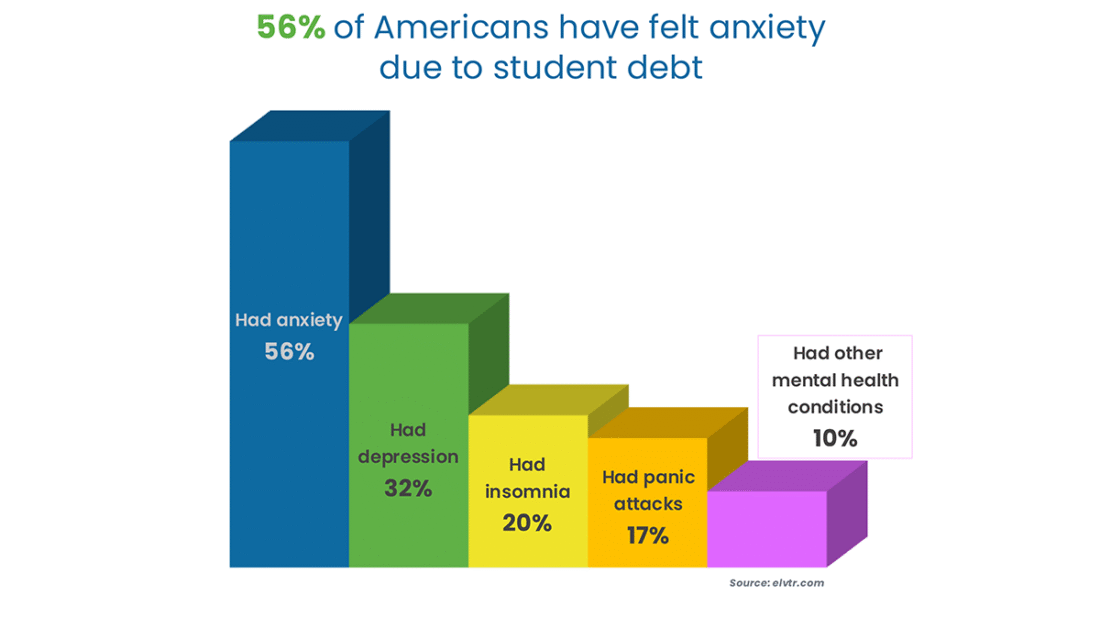

These health impacts are just as real. Borrowers reported anxiety (56%), depression (32%), insomnia (20%), and panic attacks (17%) (Robinson, 2023). Research from Northwestern also found that people in debt had higher chronic blood pressure, a physical marker of chronic stress. It also increases the likelihood of both strokes and heart attacks (White, 2022). Harvard reported that other researchers found that:

“Among the things that they determined: those with unsecured debt have fewer funds to put toward health care, food, and other practices that may promote better health; debt causes stress that exacts a physiological toll on the body; and unsecured debt itself often arises from other stressful events (such as medical needs) that themselves impact overall health and well-being. Reflective of the very real physical health concerns associated with unsecured debt, Houle, Frech, and Tumin’s analysis revealed that “those with constant high debt or accumulating debt later in life were more likely to report pain interference or stiffness” than those with constant low debt. While this research did not specifically examine student debt and its impact on physical or mental health, the lessons learned do provide a macro lens through which one can begin to assess the relationship between debt and health.” (Robinson, 2023).

The impacts of student loan debt are not felt evenly across all demographics. In fact, women account for close to 70% of all student loan debt. Black borrowers owe 186% more per capita than white borrowers. On average, four years after graduation, nearly half of Black students will owe more than they borrowed. In fact, 80% of Black college graduates report struggling to make their loan payments (ELVTR Magazine, 2023).

America’s student loan crisis is not just a financial issue—it’s a mental, physical, and an issue of overall well-being. Americans are feeling the regret too: 77% of them report being unhappy with their decision to pursue higher education because of the debt that they now find themselves settled with (ELVTR Magazine, 2023).

During the Biden administration, there was much debate about widespread student loan forgiveness and its effectiveness towards addressing the root of problem. Despite strong public interest, the American people never saw widespread forgiveness. As ELVTR’s CEO Roman Peskin explained: “Loan forgiveness, while a great initiative, is really just a Band-Aid… Before we dress up the wound, we need to stitch it up.”

During the current Trump administration, policymakers have proposed different ideas about how to address this crisis. Lawmakers are considering a cap on the amount of federal loans that can be issued, with a $200,000 limit per borrower for professional degrees (Carballo, 2025). Additionally, there are also discussions about changing the federal student loan repayment options, leading to just two repayment plans on new loans issued after July 1, 2026 (Nova, 2025). It is anticipated that the adjustment to the plan options will cause student loan payments to jump.

Until real, equitable systemic changes are made, millions of Americans will continue to face the harsh reality of this double crisis: financial debt and declining health.

The student loan crisis is no longer just an economic issue – it is quickly evolving into a public health emergency, a generational burden, and a call to action for institutions, policymakers, and communities alike.

Citations:

Caporal, J. (2025, June 9). Student loan debt 2025: Statistics, forgiveness, and outlook. The Motley Fool. https://www.fool.com/research/student-loan-debt-statistics/

Carballo, R. (2025, June 21). Republican plans to cap student borrowing could shatter an everyday profession. POLITICO; Politico. https://www.politico.com/news/2025/06/21/republican-medical-student-loan-limits-00415741

ELVTR Magazine. (2023, December 11). The financial and mental cost of the United States’ Higher education issues. ELVTR. https://elvtr.com/blog/a-failing-system-the-financial-and-mental-cost-of-the-united-states-higher-education-issues

Hanson, M. (2025, March 16). Student Loan Debt Statistics [2025]: Average + total debt. Education Data Initiative. https://educationdata.org/student-loan-debt-statistics

Moyer, C. (2023, October 26). Ninety-one percent of young adults with student loans say Financial stress is impacting their wellness — Abbott launches blueprint of award-winning program to help companies tackle this problem. Abbott Media Room. https://abbott.mediaroom.com/2023-10-26-Ninety-One-Percent-of-Young-Adults-With-Student-Loans-Say-Financial-Stress-is-Impacting-Their-Wellness-Abbott-Launches-Blueprint-of-Award-Winning-Program-to-Help-Companies-Tackle-This-Problem

Nova, A. (2025, June 20). Here’s what your student loan bill could be under new repayment plan in the Republicans’ “big beautiful” bill. CNBC. https://www.cnbc.com/2025/06/20/rap-vs-save-gops-big-beautiful-bill-may-change-student-loan-bills.html

Robinson, N. (2023). Debt Takes a Toll. Harvard Law School Center on the Legal Profession. https://clp.law.harvard.edu/knowledge-hub/magazine/issues/student-debt/debt-takes-a-toll/

White, E. (2022, January 26). Student loan debt is creating a physical and mental health crisis for millions of Americans. Network for Public Health Law. https://www.networkforphl.org/news-insights/student-loan-debt-is-creating-a-physical-and-mental-health-crisis-for-millions-of-americans/